Top 10 Companies in Odisha

Odisha has experienced significant change over the past ten years, as have very few other Indian states. The state has seen…

Top 10 Printing Companies in India

Commercial printing is the collective term for various processes used to print artwork and text on paper and cards, including layout…

Popular garment manufacturing companies in Mumbai

Mumbai, also known as Bombay, is one of the largest cities in India and a major center for textile and garment…

List of top finance companies in Mumbai

Mumbai plays a vital role in India’s economy and is a significant contributor to the country’s GDP. The finance industry in…

Piramal Group of companies

Piramal Group is a global business conglomerate with diverse interests in pharma, financial services and real estate. The Group has offices…

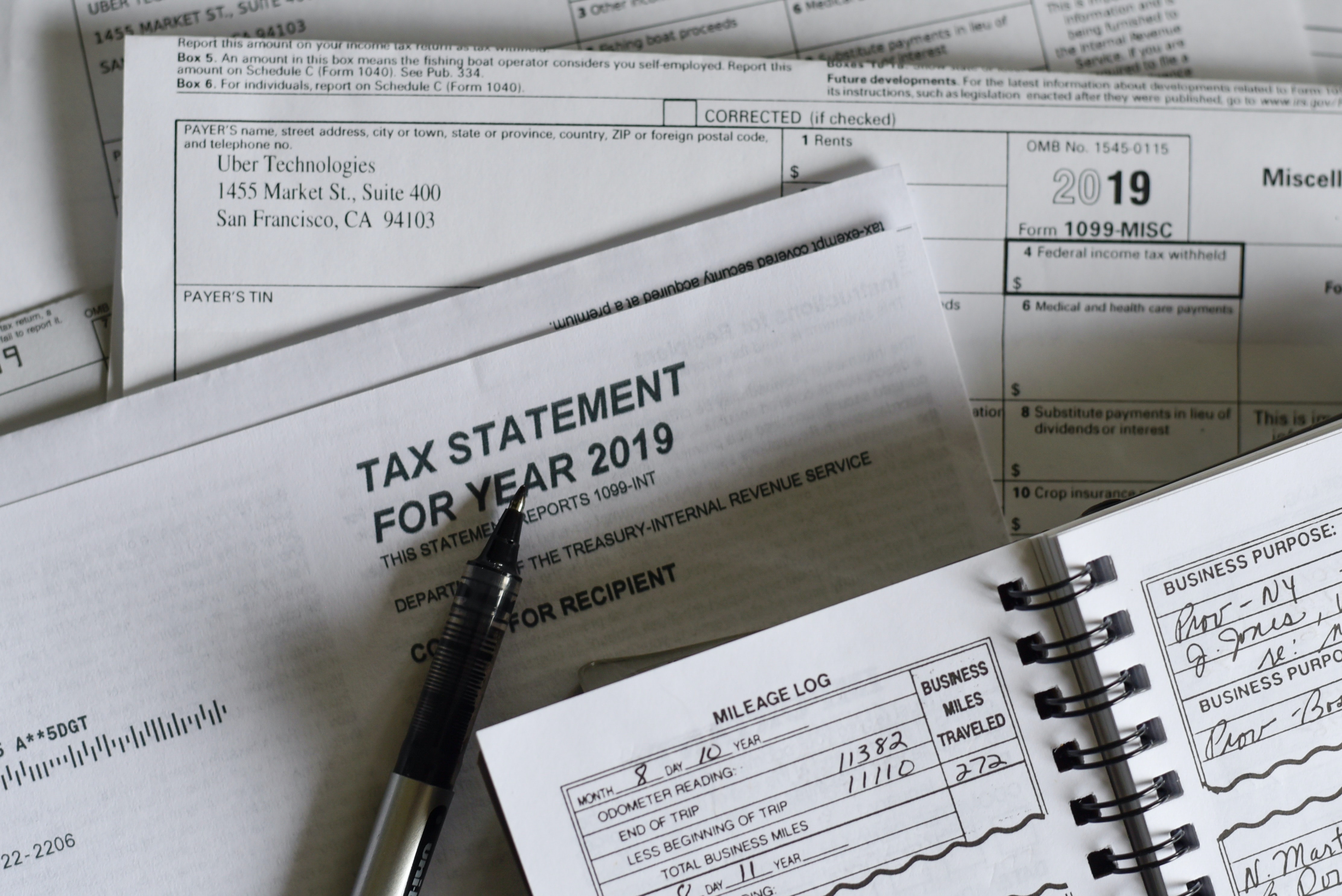

List of highest tax paying companies in India

Tax paid by a company is a direct result of its income. The more income the higher the amount of tax…

How is GST Implementation beneficial over VAT?

GST stands for Goods and Services Tax, a value-added tax levied on the supply of goods and services. Like VAT, GST…

Top Watch Brands in India 2023

A beautiful watch on your wrist is always in fashion. The type of watch band you choose will depend on your…

List Of Top Industries In Kanpur in 2023

Kanpur, the industrial capital of Uttar Pradesh, is home to a diverse range of top industries that contribute significantly to the…

List Of Top Zinc Companies in India

India is one of the world’s major producers and consumers of zinc, a vital metal used in a wide range of…

List Of Construction Companies in Kerala Kochi

The state of Kerala, located on India’s southwestern coast, is known for its vibrant culture, stunning natural beauty, and thriving economy….

Top 10 Largest Dairy Companies In India

India is one of the largest producers of dairy products worldwide, with an extensive range of products like yoghurt, cheese, butter,…

Documents Required For GST Registration

In India, any individual or business entity that engages in the taxable supply of goods or services within a state, and…

IGST – Integrated Goods and Services Tax

Under the Goods and Services Tax (GST) system, the Integrated Goods and Services Tax (IGST) rate is determined by adding the…

All About Reverse Charge Mechanism (RCM) Under GST

Reverse charge is a unique mechanism under the Goods and Services Tax (GST) framework that mandates the recipient of goods or…