Cash flow statement is one of the three key financial statements used to evaluate a Company’s financial performance and overall health. The other two financials statements – Balance Sheet and Profit and Loss account, have been addressed in earlier articles.

As its name implies, cash flow statement provides the information about the cash inflow and outflow over a specified time period. Put simply, it reveals, how efficient a company is in paying its obligation (cash outflow) and generating cash (cash inflow). Cash flow statement is the best resource to test a company’s liquidity because it shows change in its cash position over a period of time rather than an absolute amount at a specific point of time.

Statement of Cash Flow is required to be presented by large-size enterprises as defined under under AS-3.

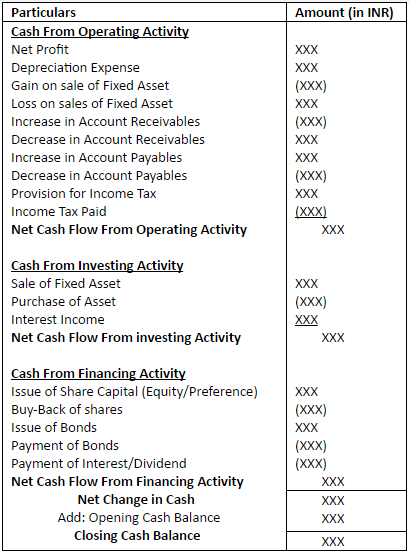

Sample of Cash Flow Statement

Difference between Earning and Cash flows

Many analysts believe that both earnings and cash flows are similar, but, there is a major difference between both. Earlier is concerned with the profitability of the company and the latter is concerned with liquidity of the company. It is very important to understand the relationship between earnings and liquidity. Higher earnings do not necessarily mean higher liquidity. For example, earnings may be more due to increase in credit sales but this would not increase the cash flows. Similarly, earnings could be low because of high depreciation in capital intensive companies but this would not affect their cash flows as depreciation is a non-cash expense. Therefore, it is imperative to read Profit & Loss statement along with Cash Flow statement.

There are two methods to prepare and present a company’s Cash Flow Statement:

Direct Method: Data used under direct method is derived from the income statement. The net cash flows are calculated by adjusting cash payments from purchases, expenses etc against cash receipts from sales, other income and more. However, it is not the method preferred by most of the firms.

Indirect Method: It derives data from the income statement and balance sheet and calculates the net cash flow by adjusting net profit, non-cash items and change therein over one period to next. It is most popular method used by the enterprises, by reversing the net profit of income statement to reach at net cash flow.

As already mentioned, a cash flow statement shows the effect of changes in balance sheet accounts and income on cash and cash equivalents. The statement breaks down the analysis to operating, investing, and financing activities.

Operating Activities:

Cash flow from operating activities is a key indicator of the extent to which the operations of an enterprise are able to generate sufficient cash to keep the company running. It shows:

- Company’s ability to generate cash from its operations.

- Changes in working capital like payment to creditors, receipts from debtors, any changes in inventory.

- The adjustment for non-cash expenses like depreciation, amortization, income tax, etc.

Investing Activities:

Cash flow from investing activities indicates the aggregate change in a company’s cash position which can result from any gains (or losses) from the investments in the financial markets and its operating subsidiaries, and changes that result from investments in capital assets such as plant, equipment and machinery. To illustrate, some of items dealt here are:

- Purchase of plant and machinery

- Investment in mutual funds, quoted and unquoted securities

- Sale of land and furniture etc.

Financing Activities:

Cash flow from financing activities reflects the external activities that allow a company to raise capital and repay investors, such as issuing new capital, borrowing a loan from a bank, paying cash dividends to shareholders, etc. It is also an indicator showing the sources of funds over a particular period. Some examples are:

- Redemption of debentures

- Payment of interest or dividend on debentures or capital respectively

Cash Flow Statement consideration

Total change in cash flow from operating, investing and activities gives us net change in cash.

Conclusion:

- Cash Flow Statement analysis indicates soundness of cash management of the company.

- It indicates internal ability of the company to generate cash rather than dependence on outside financing.

- A comparative analysis of cash flows of various companies gives deep insight into financial strength and sustainability of these companies.

Therefore, it is imperative to read and analyze Cash Flow Statements along with Financial Statements, to take a wider perspective on financial health of the company.

For Annual Reports, Balance Sheets, Profit & Loss, Company Research Reports, directors and other financial information on ALL Indian Companies, head over to www.tofler.in – Business Research Platform.

Author– Harsh is a CA final aspirant with a Bachelor degree in Law. Nothing makes Harsh happier than writing on his field that can enhance his readers’ domain know-how. He loves to play with numbers and learn new things.

Editor – Anchal, co-founder at Tofler, is a CA, CS and has more than 5 years experience in company analysis. She likes to explore and track companies, their performance and senior management.