The Goods and Services Tax (GST) is a value-added tax that was introduced in India in July 2017. The impact of GST on airfares in India has been mixed.

Before GST was implemented, air travel was subject to airfares taxes, including service tax, excise duty, and value-added tax (VAT). The total tax burden varied from state to state, resulting in different air fares in different parts of the country.

With the introduction of GST, all of these taxes were replaced by a single tax, which was set at a standard rate of 5% for domestic air travel and 12% for international air travel. This reduced the tax burden for some airlines, particularly those operating in states with high VAT rates.

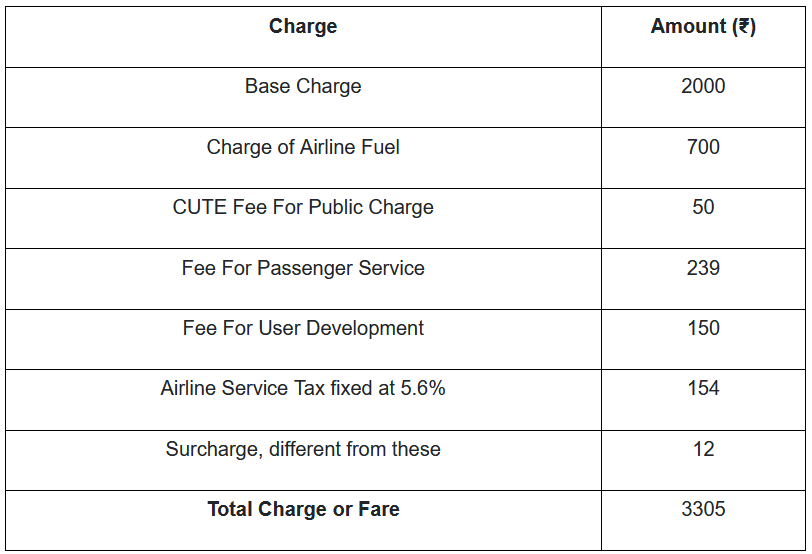

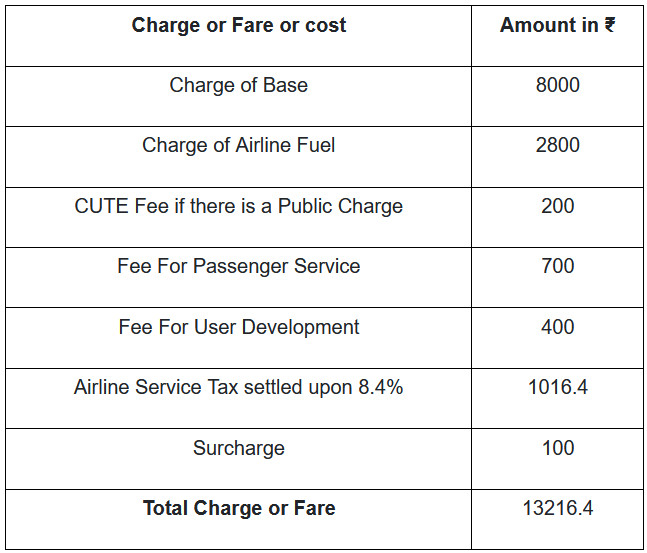

The Tax rates under the Service Tax regime was:

| Tickets | Rate of Service Tax |

| Economy Class | 5.6% |

| Business Class | 8.4% |

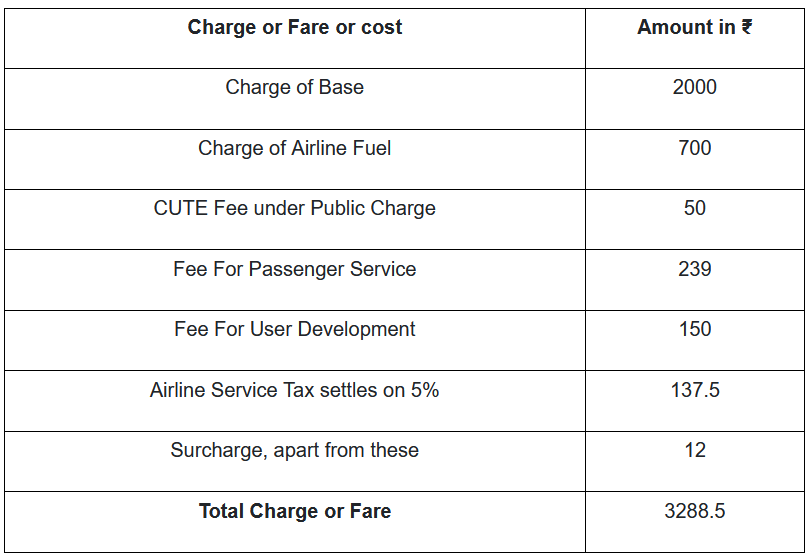

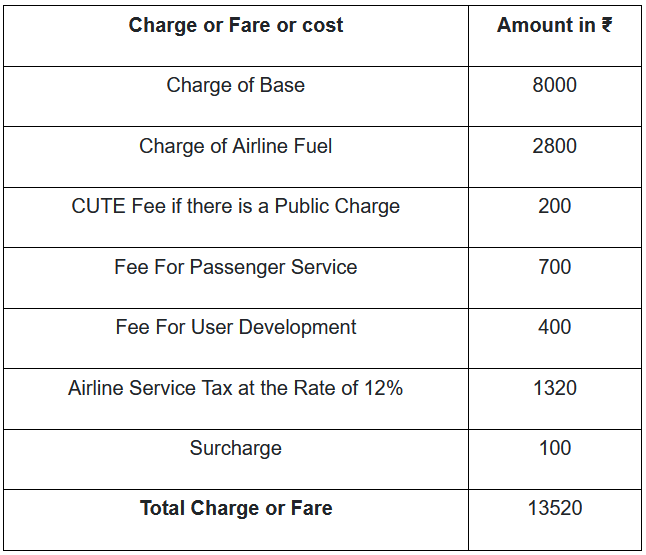

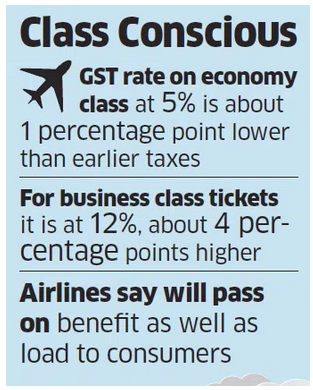

Under the new GST regime; the tax rate for economy-class flight tickets are 5%. Whereas, the business-class attracts a higher tax at 12%. Thus, the revised tax under GST regime is:

| Tickets | Rate of GST |

| Economy Class | 5% |

| Business Class | 12% |

Domestic air travel will obviously grow after the introduction of GST, which has lowered air travel prices. So, budget travelers have reason to rejoice and plan their upcoming vacations. Business class fares, on the other hand, will be more expensive, but this is only a small increase from 9% to 12%. A small increase in travel prices may not be enough to deter business travelers from planning their trips.

The air fare calculation for economy class:

The air fare calculation for business class:

A bigger portion of the airline’s revenue comes from economy-class travelers. Additionally, airlines may only request ITC for economy inbound services but may request ITC for consumables other than spare parts, food, and fuel for business class.

The impact of GST on airfares in India has been mixed, with some airlines reducing fares and others increasing them. The impact has varied depending on factors such as the airline’s operating costs, the tax burden in different states, and the GST rates on goods and services used by airlines.

Here are some of the top frequently asked questions about GST charges on airfare:

- Who has to pay GST on airfare?

Ans. Passengers who book air tickets have to pay GST on airfare. The GST is included in the ticket price and is collected by the airlines.

- Is GST on airfare applicable to all airlines?

Ans. Yes, GST on airfare is applicable to all airlines operating in India, including domestic and international airlines.

- Are there any exemptions from GST on airfare?

Ans. Yes, there are some exemptions from GST on airfare. For example, air tickets booked for government officials and armed forces personnel on official duty are exempt from GST.

- Can I claim a refund on GST paid on airfare?

Ans. No, you cannot claim a refund on GST paid on airfare, even if you cancel your ticket. However, if the airline cancels the flight, you are entitled to a refund of the ticket price, including the GST.