Broadly speaking, credit rating is an assessment of the creditworthiness of a business. A good credit rating means strong financials and a high likeliness of paying off financial obligations timely.

There are about 6 credit rating agencies in India that provide ratings to businesses. These ratings can be provided to a business as a whole or on a specific financial obligation ‘technically called instrument’ of the business. The duration of these financial obligations vary and are typically categorized as long term and short term. Either way, they denote the financial health and creditworthiness of the business.

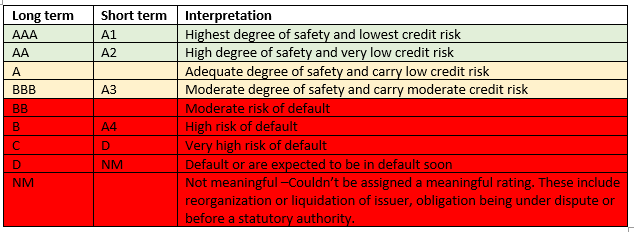

These ratings are typically categorized into long term and short term along with the type of the instrument for which the rating is issued. These are usually denoted in alphanumeric symbols. Having more letters in the rating is generally better than fewer letters, and being earlier in the alphabet indicates higher quality.

Without getting into nuances of credit ratings, this article provides you a guideline on how to interpret any credit rating issued to a business:

Note: A plus (+) or minus (-) sign may be appended to the above ratings to indicate relative standing within each rating category. Example: AAA+ is a higher rating than AAA.

While talking about credit ratings, we can’t skip the concept of ‘Investment grade ratings‘. This term denotes companies with strong financial strength and capacity to pay back their financial obligations. All ratings equal and above BBB- are categorized as investment-grade ratings. For example, specific debentures of Tata Motors are rated as ‘AA’ (investment grade rating). However, instruments of Jet Airways have been rated as ‘D’.